Dissecting the Lotus Metamorphosis: The Company

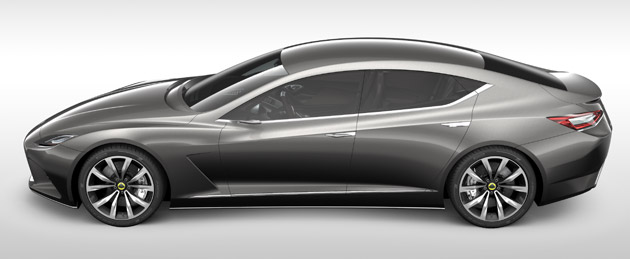

Lotus sent a cryptic missive last year indicating it wanted to challenge Porsche and Ferrari. Aiming at those targets, it pulled the trigger five times at the Paris Motor Show this year, unleashing the new Elise, Elan, Esprit, Elite and Eterne showcars. Then came the name for the project, “The Metamorphosis,” and its tidings of a new era. Yet behind all the modern interpretive art, there are the simple nuts and bolts of getting a car company into a new place. Follow the jump to find out what we learned.

Continue reading…

The Problem: The Elise

“The last 15 years the brand has maneuvered itself into a corner where it served a niche, the enthusiasts,” says CEO Dany Bahar. “That’s why Lotus was always on the verge of financial collapse.”

The Lotus Elise has played a prominent and double-edged role in both the success and the difficulties of the British company.

“We’ve sold more than 45,000 Elises,” Bahar tells us. “I wouldn’t say it [has been a] problem, but since it was a very successful car the Elise has defined what Lotus is today.”

Lotus founder Colin Chapman’s lightweight-above-all mantra is a cornerstone of the company, and while the Elise maintains, it hasn’t left the brand enough room to maneuver with mainstream sports car consumers. The brand’s reputation made people look askance when it talked about building what, by Lotus standards, would be a big, heavy sports car.

The Lotus Metamorphosis is about taking that ground back. “It’s not wrong that a car weighs more than 1,000 kilograms,” said Bahar. “It’s not wrong that a car is longer than three meters or has a V8.”

When Lotus announced its intentions to go the luxury sports car route last year, people were wary, but the company wants to remind everyone that the position isn’t new. When Bahar looked at 150 magazines from the ’70s, ’80s and ’90s, he found the Esprit was always compared to Porsche, Ferrari and Maserati. It isn’t that Lotus is trying to get to new ground – it’s trying to get back to ground it abandoned.

That’s why when Bahar was asked if he knew who the template was for the new Lotus customer, he immediately answered, “The Porsche customer.”

With the Stuttgart firm going more mainstream practically every quarter, Lotus sees a chance to bring individualism and small-volume character to a space that Porsche, by its sheer ubiquity, is leaving. In fact, the reasoning is similar to what another English automaker planned to do a few years ago with a coupe called the Vantage V8.

“Maybe Porsche’s aspirational customer,” Bahar said, “comes to Lotus.”

The Cost of Metamorphosis: £770,000,000

Bahar said that the plan has only properly been in the works for about the last 12 months, and the banks have handed over £770 million pounds ($1,243 billion U.S.) to pay for the chrysalis act. Those come off as fly-by-night numbers and a tiny bit of coin when one considers traditional development budgets for five cars, building out the new facilities and infrastructure, and the advertising and marketing needed to seed and grow the new brand consciousness.

The two caveats in Lotus’s case are that the five cars – Elise, Elan, Esprit, Elite and Eterne – are only 2.5 cars in engineering terms thanks to extended modularity and shared components. Also, according to Bahar, the development budget for a small maker like Ferrari or Aston is just £100-£150M per car, and he says Lotus is in that range.

The point of coming out with five cars was to spread the risk. “Today we sell niche, small cars,” said Bahar, “2,500 to 2,700 cars per year – not enough to keep the company alive. There were two ways to do it: build two cars and sell as many as possible, and we don’t think we can sell enough of two cars. The other way was to build more cars. It’s more conservative, but it’s more expensive up front.”

“You’re spreading the risk with more cars,” said former GM man Bob Lutz, who’s on the Lotus advisory board. “It is a gamble. When you have a brand that was kind of fading, as Lotus was, if you do nothing it’s certain death, if you pump in a massive investment it’s maybe death. But the investment is a tiny fraction of what it would cost GM to do this” with the modular vehicle architecture and massive differences in costs between things like carbon fiber tooling versus steel tooling.

“We’re only talking about a certain volume,” said Lutz. “It will be feasible or close if they can do that without spending a fortune. I personally give this a substantial chance of success.”

They also have an eye on selling the platforms and engineering to other automakers as a way to defray costs. Lotus Group’s engineering arm has 700 engineers, three times as many as Ferrari according to Bahar. They make up more than a third of the company’s 2,000 employees, and they work for third parties including every single OEM. So not only the platforms that the Group develops, but the galaxy of engineers will also contribute to the bottom line.

If we take the company at its word and, on the high end, Lotus is investing £450 million just for the cars, where’s the other £320 million going? To build the back end of revenue generation, said Bahar: “investments like the proper management of licensing and merchandise,” a new headquarters at Hethel, a new and more demanding test track, new motorsports facility, new Lotus heritage center, and general improvements to the Hethel site “to make it more representative of Lotus in the future.”

Bahar let dangle a question about engines, though. Naturally, no one at Lotus would be drawn out on specifically which engines we can expect to see in the future, but he said “We have three months to decide. We have three engines to choose from, from a four-cylinder to a V6 or V10 with our long-standing relationship with Toyota. Or we might develop our own.”

We’d be surprised if Lotus risked funds right now to develop its own engines, especially when there is so much potential with just the possibilities we know about.

“The funding is in place,” he said. “We have to fight about delivering.”

And by investing in everything now, in a market that remains depressed, the company expects to be loaded and ready when things rebound.

Win on Sunday…

Perhaps you noticed that motorsports wasn’t mentioned as a cost to be taken out of the £770 million budget. That’s because motorsports is now viewed as a profit center, not an account payable. Lotus is, however, putting money into facilities for its motorsports efforts, like a 5,000-square-meter factory and its FIA-certified test track at Hethel.

“Funds all went to racing before, with Colin Chapman,” said Bahar, which is why customer cars could be left to want for development. “Now motorsports has to make a business case beforehand. You need to have teams lined up to buy the cars before you commit to racing – GT2, GT4, Le Mans, Exos, it’s a profit center.”

Claudio Berro, who headed Ferrari’s race efforts before coming to Lotus, is now the English firm’s motorsport director. He believes that having a car like the Evora in GT4 “shows the potential of the road car, since 80% of a GT car is the production car.”

Beyond that, plans are expansive: next year there will be two or three cars in IndyCar, and in 2012 the series will use Lotus bodywork, plus a closed-cockpit American Le Mans challenger, GP2 and GP3 programs, an Evora GT2 endurance racer, and the renamed Lotus Cup in the U.S., UK, Italy, Middle East, Japan and Eastern Europe with between 40 and 50 cars in every one of the Cup series.

To manage the task, Lotus is bringing all of its motorsport activities back in-house – hence the Lotus Racing snafu with Tony Fernandes’ F1 team, which Lotus had no comment on.

The New Lotus: 6,000 to 8,000 Annual Sales

The team that Bahar, who headed Ferrari’s marketing before taking the Lotus position, has built includes quite a few of his former Ferrari colleagues. Still, he poached from other hallowed marques, such a acquiring Michael Och and Erik Ruge from Porshce and Chief Technical Officer Wolf Zimmerman, who spent 19 years in the same position at Mercedes-Benz’ AMG division.

And in effort to make sure they didn’t simply get high on their own ideas, the company’s new advisory board includes Tom Purves formerly of BMW and Rolls-Royce, ex-BMW R&D chief Burkhard Goeschel, auditing firm KPMG, and Bob Lutz, who “eagerly accepted” his position once General Motors determined that Lotus wasn’t a competitor.

Lutz’s take on the company’s plans: “It’s a complete departure from where Lotus has been – I think there have been some weak points from a product standpoint. What the company wants to do is break through and become a much more engaged participant” when it comes to this end of the sports car segment.

“For the first time the company has the funding to do the kind of cars that other manufacturers can only dream of,” Lutz continued.

In 2015, when all five cars are meant to be in showrooms and on the market, Lotus expects volume to be between 6,000 and 8,000 cars per year, which means they’d only need to sell 1,600 each of the five they’ve introduced.

The ethos of those cars, beyond the core tenet of performance through light weight, will be “about the interaction of driver and car,” said Bahar, “fun to drive, great ride and handling and innovation – British products of ultra high performance and best in emissions.”

The emissions part is a crucial platform in the metamorphosis. Zimmerman, the chief technical officer, says, “We believe hybrid systems will be the future. It doesn’t need to be a full hybrid. Our benchmark is to be lowest in class” in emission, somewhere around the 200 g/km mark that represents between 20 and 30 miles per gallon.

The emissions part is a crucial platform in the metamorphosis. Zimmerman, the chief technical officer, says, “We believe hybrid systems will be the future. It doesn’t need to be a full hybrid. Our benchmark is to be lowest in class” in emission, somewhere around the 200 g/km mark that represents between 20 and 30 miles per gallon.

The “next generation of cars,” he said, “will match, if not exceed, competitors in sports and supercars with performance, design, technology, and emissions.”

One of the biggest question marks outside the company, though, is where you’ll buy them. Lotus terminated its entire dealer network in Europe and is working through the process of restructuring its American distribution system. Bahar said the process is about 60 percent complete, and that only about 10 percent of current Lotus dealer network will hold on to their franchises.

Stay tuned for part two of the Lotus Metamorphosis, where we’ll get into all the details of the cars those dealers will be offering.